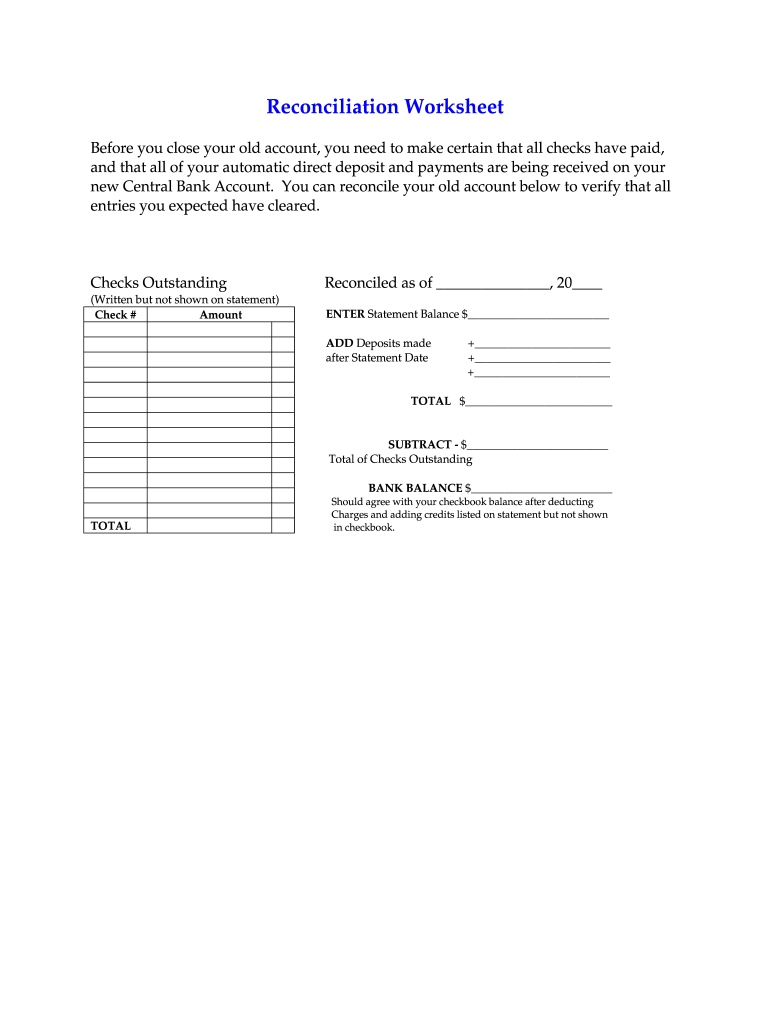

Get the free tax return reconciliation worksheet form

Get, Create, Make and Sign

How to edit tax return reconciliation worksheet online

How to fill out tax return reconciliation worksheet

How to fill out tax return reconciliation worksheet:

Who needs tax return reconciliation worksheet:

Video instructions and help with filling out and completing tax return reconciliation worksheet

Instructions and Help about 1040 tax reconciliation worksheet form

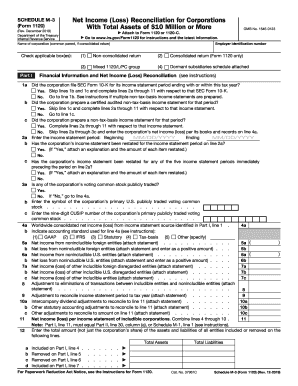

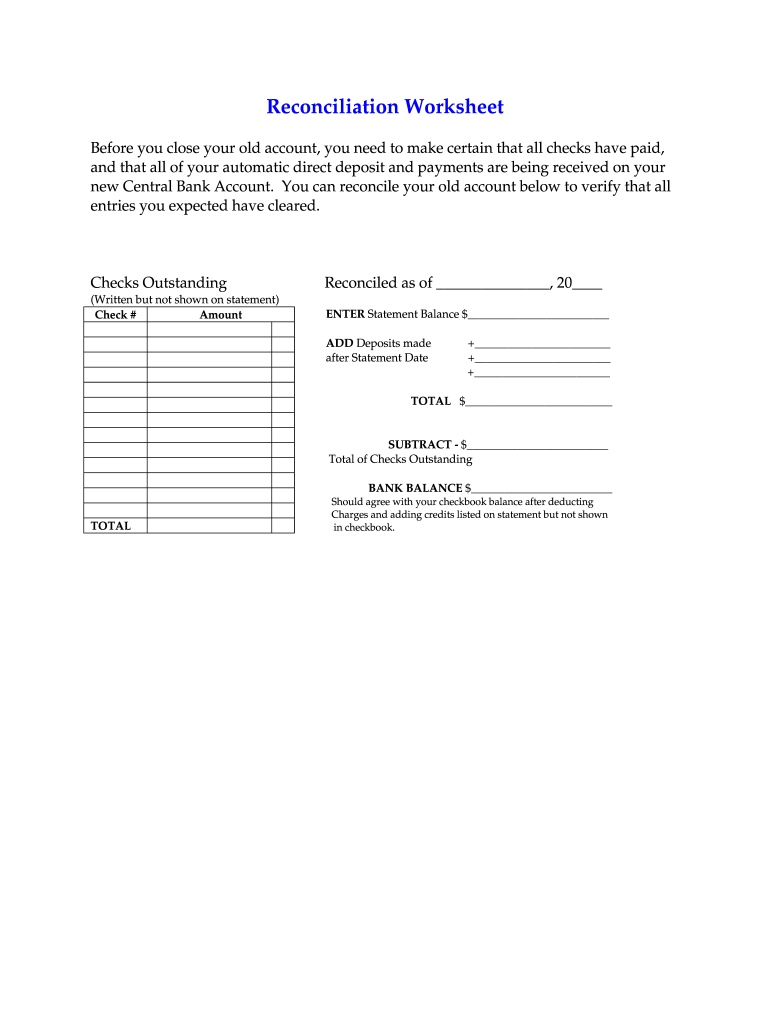

Law.com legal forms guide Montana individual income tax amended return reconciliation worksheet residents non-residents and part year residents of Montana who file an amended income tax return with the state must include a reconciliation worksheet to explain all changes they are documenting this document is found on the website of the Montana Department of Revenue step one at the top of the form and to your first name middle initial and last name do the same for your spouse if you filed a joint return step to enter your social security number as well as that of your spouse if applicable step 3 enter the year of the tax year which you are amending step for the worksheet contains three columns all of which must be completed the first column requires you to record the figures as initially reported or last amended the second column requires you to document the net change between the original and correct figures the third column requires you to document the amended numbers Step five lines one through seven document your additions and deductions step 6 lines 8 through 25 provide instructions for the calculation of tax owed if you are due a refund this will be entered on line 24 if you have tax due this will be entered on line 25 step 7 on the second page to chart is provided to document all reported changes the first column requires you to enter the tax form or schedule which is being amended the second column requires you to enter the line number being amended the third column requires you to provide a written explanation for the change attach additional sheets if necessary to explain all changes step 8 this worksheet should be attached to your amended return and does not act as a substitute for it, you do not need to sign this worksheet only the amended return on the return you may include the name and phone number of a third party contact person authorized to discuss your amended return to watch more videos please make sure to visit laws dot com

Fill reconciliation worksheet fill : Try Risk Free

People Also Ask about tax return reconciliation worksheet

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax return reconciliation worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.