Central Bank Reconciliation Worksheet free printable template

Show details

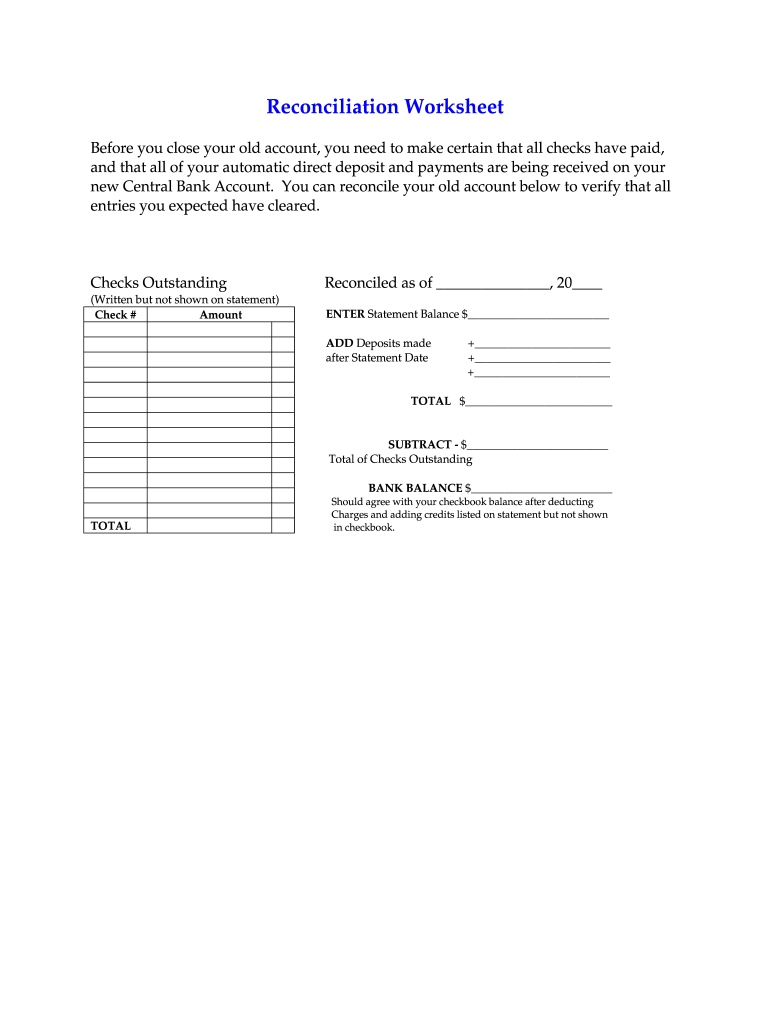

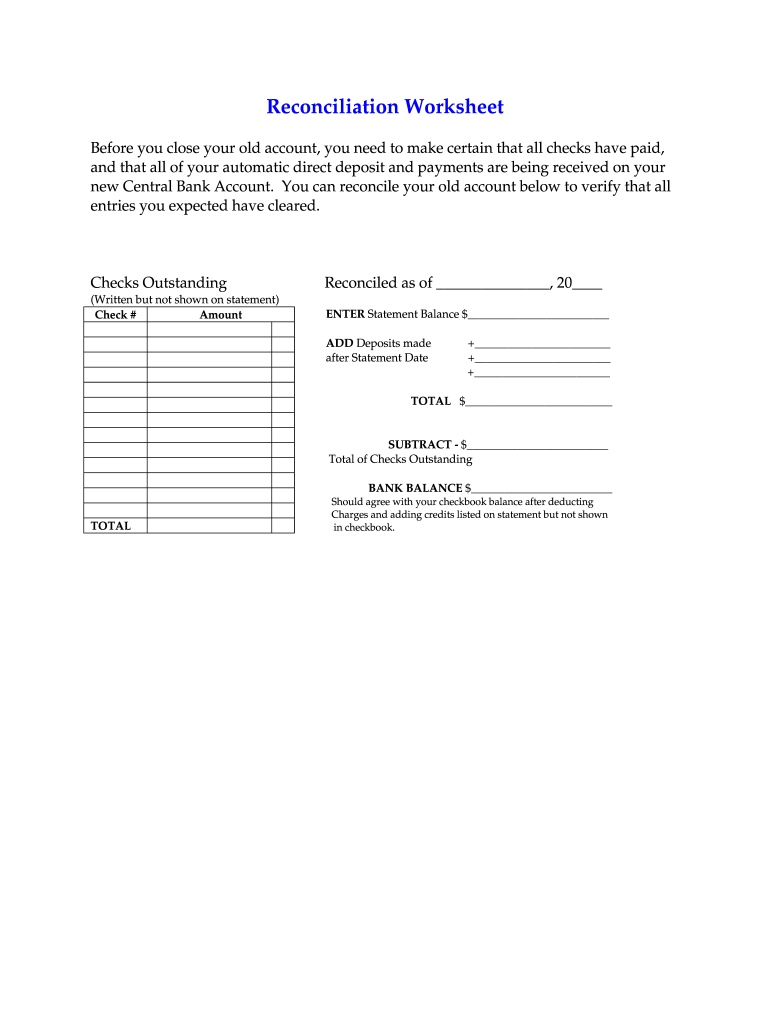

Reconciliation Worksheet Before you close your old account you need to make certain that all checks have paid and that all of your automatic direct deposit and payments are being received on your new Central Bank Account. You can reconcile your old account below to verify that all entries you expected have cleared* Checks Outstanding Reconciled as of 20 Written but not shown on statement Check Amount ENTER Statement Balance ADD Deposits made after Statement Date TOTAL SUBTRACT - Total of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign reconciliation worksheet pdf form

Edit your mrs jones has received her bank statement and is ready to reconcile it with her checkbook register fill out the reconciliation worksheet for mrs jones using the data from her bank statement and checkbook register assume all transactions on previous pa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reconciliation worksheet fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax return reconciliation worksheet online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit the reconciliation report is a for income paid to date form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the reconciliation report is a worksheet that provides details of the end of the year form

How to fill out Central Bank Reconciliation Worksheet

01

Gather all relevant bank statements for the period being reconciled.

02

Obtain the company's cash book or bank ledger.

03

Compare the bank statement balance to the cash book balance.

04

Identify any discrepancies between the two balances, including outstanding checks and deposits in transit.

05

List all reconciling items on the Central Bank Reconciliation Worksheet.

06

Adjust the cash book balance by adding deposits in transit and subtracting outstanding checks.

07

Confirm the adjusted cash book balance matches the bank statement balance.

08

Document any errors and make corrections in the cash book if necessary.

Who needs Central Bank Reconciliation Worksheet?

01

Businesses and organizations that maintain a checking account.

02

Accountants and finance professionals responsible for financial reporting.

03

Auditors who require verification of cash balances.

04

Anyone involved in managing cash flow and financial transactions.

Fill

tax reconciliation worksheet

: Try Risk Free

People Also Ask about k 1 reconciliation worksheet

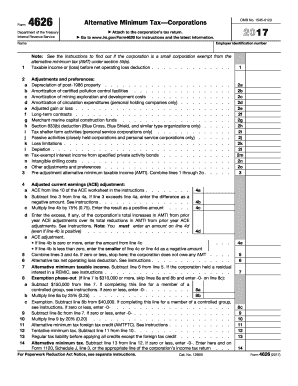

What is form 8916 for?

Use this form to provide a detailed schedule of the amounts reported on the applicable Schedule M-3 for cost of goods sold, interest income, and interest expense.

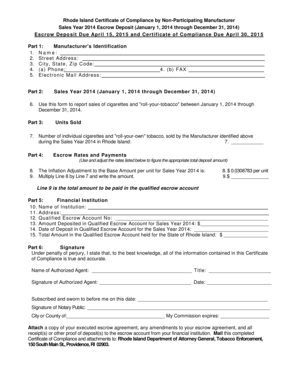

What is a tax return reconciliation?

To reconcile, you compare two amounts: the premium tax credit you used in advance during the year; and the amount of tax credit you qualify for based on your final income. You'll use IRS Form 8962 to do this. If you used more premium tax credit than you qualify for, you'll pay the difference with your federal taxes.

How do I reconcile form 941?

Follow these five simple steps to reconcile Form 941. Gather payroll registers from the current quarter. Make sure wages are accurate. Compare federal income taxes withheld. Review Social Security wages and tips. Compare Medicare wages and tips.

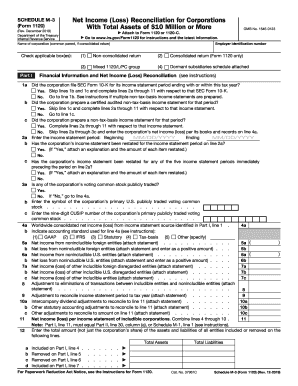

What is the tax return reconciliation worksheet?

The reconciliation report is a worksheet that provides details of tax deducted to date as against the tax that should be deducted for income paid to date. It also contains details of the year-end re-computed tax on the final income figures of wages/salary and other payments at the end of the year.

What is income reconciliation on tax return?

noun. (Accounting: Financial statements) A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items.

What is tax return reconciliation worksheet?

The reconciliation report is a worksheet that provides details of tax deducted to date as against the tax that should be deducted for income paid to date. It also contains details of the year-end re-computed tax on the final income figures of wages/salary and other payments at the end of the year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my reconciliation worksheet in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 1040 reconciliation worksheet along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit reconciliation form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing reconciliation worksheet fill and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the reconciliation report is a the end of the year using my mobile device?

Use the pdfFiller mobile app to fill out and sign 1040 worksheet. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is Central Bank Reconciliation Worksheet?

The Central Bank Reconciliation Worksheet is a financial document used to reconcile the balances between a bank's records and its internal financial statements to ensure accuracy and completeness in accounting.

Who is required to file Central Bank Reconciliation Worksheet?

Financial institutions, including banks and credit unions, are typically required to file the Central Bank Reconciliation Worksheet as part of their regulatory obligations to ensure accurate records.

How to fill out Central Bank Reconciliation Worksheet?

To fill out the Central Bank Reconciliation Worksheet, one must gather relevant financial data, such as the bank's statements and internal records, then systematically compare and adjust the figures to reconcile discrepancies.

What is the purpose of Central Bank Reconciliation Worksheet?

The purpose of the Central Bank Reconciliation Worksheet is to confirm that the financial records of a bank are in alignment with the bank's actual cash balances, which aids in identifying errors, fraud, or discrepancies.

What information must be reported on Central Bank Reconciliation Worksheet?

The information reported on the Central Bank Reconciliation Worksheet includes account balances, transaction details, adjustments made, and explanations for any discrepancies that arise during the reconciliation process.

Fill out your Central Bank Reconciliation Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Book To Tax Reconciliation Template is not the form you're looking for?Search for another form here.

Keywords relevant to reading schedule with task column pages 29 1040 dec 15 to jan 27

Related to tax reconciliation template excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.